As a major pillar of the distribution industry, shippers and logistics service providers are a critical element of any business’ customer satisfaction goals. But as a facility manager or a business that relies on a shipping partner to help you meet your service goals, how much information do you share between you in order to ensure you can make the relationship as productive as possible? A recent industry survey by Descartes Systems Group, a solutions provider for fleet management operations, provides some useful insights.

The Two Types of Service Providers

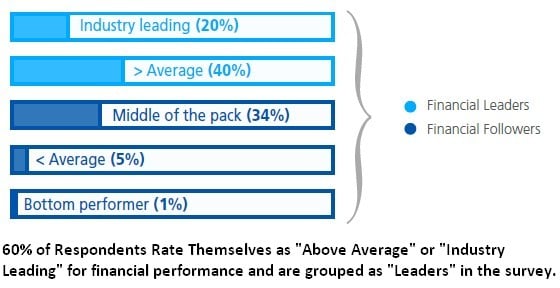

The Descartes research surveyed over 100 shippers and logistics service providers and used an interesting data point to bifurcate the results, which for lack of a better word, I’ll refer to as the “haves” and “have nots”. Essentially, those who rated themselves as “above average” or “industry leading” in regards to their overall financial performance, were reported on separately from those who did not, and labeled them as either “Financial Leaders” or “Financial Followers”. At first glance it is not obvious that this makes for a logical point of division, but the responses to the other parts of the survey quickly highlights the validity of the model.

What the data shows what really separates the Leaders from the Followers is that the Leaders more profitable model allows them to be more forward-looking, aggressive and willing to tackle longer-term challenges. Let’s dig in and see how it impacts their planning and outlook.

Not All Growth is Equal

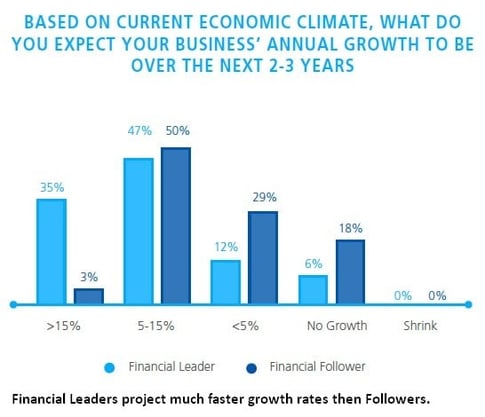

When asked about their expectations for growth, 35% of the Leaders predicted >15% versus only 3% of then Followers. And while the two groups second quintile are somewhat equal at 47% vs. 50%, a full 47% of Followers expect growth to be as little as 0-5% versus only 18% of the Leaders.

While we might be able to say that the reason Leaders are classified that way is because of their expected growth, the rest of the survey indicates what is being posited here – that strong financial health is a key to creating the ingredients to faster growth.

Growth is good in general, but fast growth over 15% puts tremendous pressure on both productivity and performance levels.

Impacts and Challenges Familiar to Warehouse Managers

Before digging deeper into the differences between Leaders and Followers, the survey shares the biggest challenges selected by respondents. Unsurprisingly, anyone managing a distribution center or warehouse will find it to be a familiar list! Asked which TWO challenges will have the largest impact, a whopping 65% identified labor shortages as significant, doubling the totals for “More Demanding Customers” and “Fuel Costs” at 33%.

In what is statistically a 3-way tie for second, “ELD/HOS” (Electronic Logging Devices/Hours of Service) ranked high too. However, with “eCommerce/Home Delivery” at 14%, we tend to see this as bolstering “More Demanding Customers” as the real second-place response. Our bet is that much of what makes customers “more demanding” stems from the continuous expansion of eCommerce in every part of the economy.

One thing of interest however, is how low the “future” technology of Driverless Vehicles ranks. Whether a Leader or a Follower, this is clearly something that shippers are letting someone else solve for now and not making it a priority. While DC managers share the same challenge with staffing, our guess is that there is a larger percentage of them looking at automation as something they can execute on in the near-term as many of the technologies are already available and are being deployed by industry leaders already.

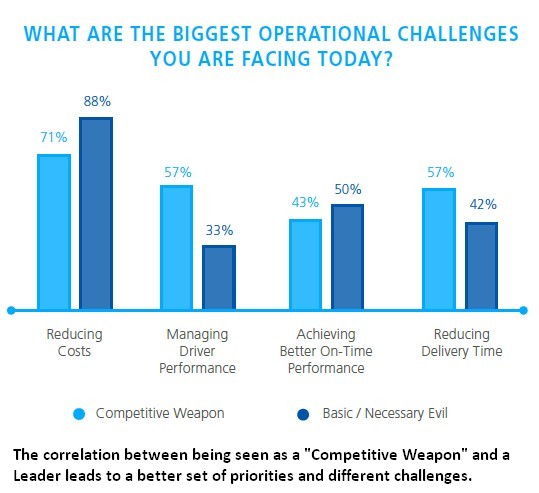

When it comes Operation Challenges, the survey also found some familiar insights (in order):

- Reducing Costs

- Managing Driver Performance

- Achieving Better On-Time Performance

- Reducing Delivery Time

- Eliminating Paper-based Processes (not shown)

While we won’t cover it here today, the survey also breaks down the respondents into two additional categories – one where their function is viewed by management as a “Competitive Weapon” and the other a “Basic/Necessary Evil”. If you review the full survey later, you’ll find some of those differences fascinating, though somewhat logical.

Where Do They Go From Here?

When prioritizing investments for effective fleet management, respondents focused on route planning (19%) and dispatch/tracking (12%) as their top two, along with delivery appointment booking and driver performance to round out the areas to focus on going forward. One of the surprises from the survey is that only 31% indicated the presence of a mobile application to enhance customer experience.

One other interesting insight is an apparent gap in capabilities utilized by the industry. Despite the expressed prioritization of “Route Planning”, “Better Booking” and related areas for overall performance, actual deployment of Route Planning solutions lags relatively far behind, presenting an opportunity for those creating these tools for the industry.

After seeing this data, what types of potential changes would a facility manager consider with the challenges their service providers are facing? This data might be a useful guide to reviewing your current shipper relationship under new criteria. For example, are they a “Leader” or a “Competitive Asset”? While a “Follower” sounds more like a vendor who might feel obligated to make a bargain to get your contract, the Leader seems better poised to deliver on a higher level of service, now and in the future. What’s your priority?

Survey excerpts are from the “2019 Fleet Management Benchmark Survey” by Descartes. See the full report here.